Simple Exponential Smoothing

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from statsmodels.tsa.api import SimpleExpSmoothing

df = pd.read_csv('/content/all_stocks_5yr.csv')

apple_df = df[df["Name"] == "AAPL"].copy()

apple_df["date"] = pd.to_datetime(apple_df["date"])

apple_df.sort_values("date", inplace=True)

apple_df.set_index("date", inplace=True)

apple_df = apple_df.asfreq('B')

apple_df["close"] = apple_df["close"].interpolate()

apple_close = apple_df["close"]

plt.figure(figsize=(10, 4))

plt.plot(apple_close, label="Apple Closing Price", color="black")

plt.title("Apple Stock Closing Prices")

plt.xlabel("Date")

plt.ylabel("Price")

plt.legend()

plt.grid(True)

plt.show()

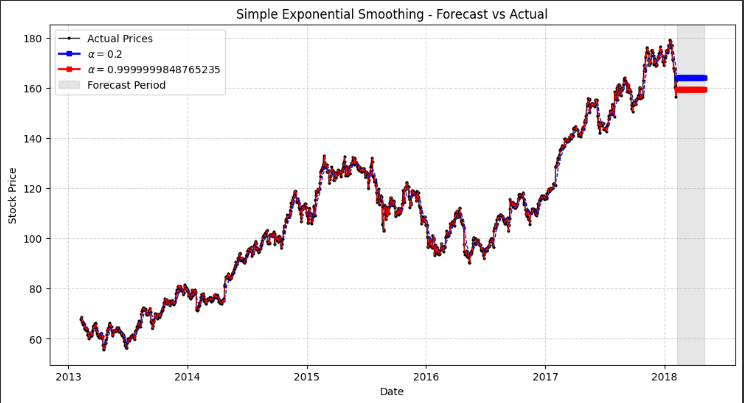

fit1 = SimpleExpSmoothing(apple_close).fit(

smoothing_level=0.2, optimized=False

)

fcast1 = fit1.forecast(60).rename(r"$\alpha=0.2$")

fit2 = SimpleExpSmoothing(apple_close).fit()

fcast2 = fit2.forecast(60).rename(r"$\alpha=%s$" % fit2.model.params["smoothing_level"])

# Plot actual data

plt.figure(figsize=(12, 6))

plt.plot(apple_close, marker="o", color="black", markersize=2, linestyle="-", linewidth=1, label="Actual Prices")

# Plot fitted values

plt.plot(fit1.fittedvalues, linestyle="--", color="blue", linewidth=1)

plt.plot(fit2.fittedvalues, linestyle="--", color="red", linewidth=1)

#plt.plot(fit3.fittedvalues, linestyle="--", color="green", linewidth=1)

# Forecast lines (thicker & different markers)

(line1,) = plt.plot(fcast1, marker="s", color="blue", markersize=4, linestyle="-", linewidth=2, label=fcast1.name)

(line2,) = plt.plot(fcast2, marker="s", color="red", markersize=4, linestyle="-", linewidth=2, label=fcast2.name)

# Highlight forecast area

plt.axvspan(fcast1.index[0], fcast1.index[-1], color="gray", alpha=0.2, label="Forecast Period")

# Add legend

plt.legend(loc="upper left")

plt.title("Simple Exponential Smoothing - Forecast vs Actual")

plt.xlabel("Date")

plt.ylabel("Stock Price")

plt.grid(True, linestyle="--", alpha=0.5) # Light grid for better readability

plt.show()

Ryan is a Data Scientist at a fintech company, where he focuses on fraud prevention in underwriting and risk. Before that, he worked as a Data Analyst at a tax software company. He holds a degree in Electrical Engineering from UCF.